The new report of the Massachusetts Institute of Technology (MIT) questioned the popularity of AI in business, causing a decrease in shares of technological companies. The study The Genai Divide: State of Ai in Business 2025 showed that less than one of the ten experimental programs of AI turned out to be profitable.

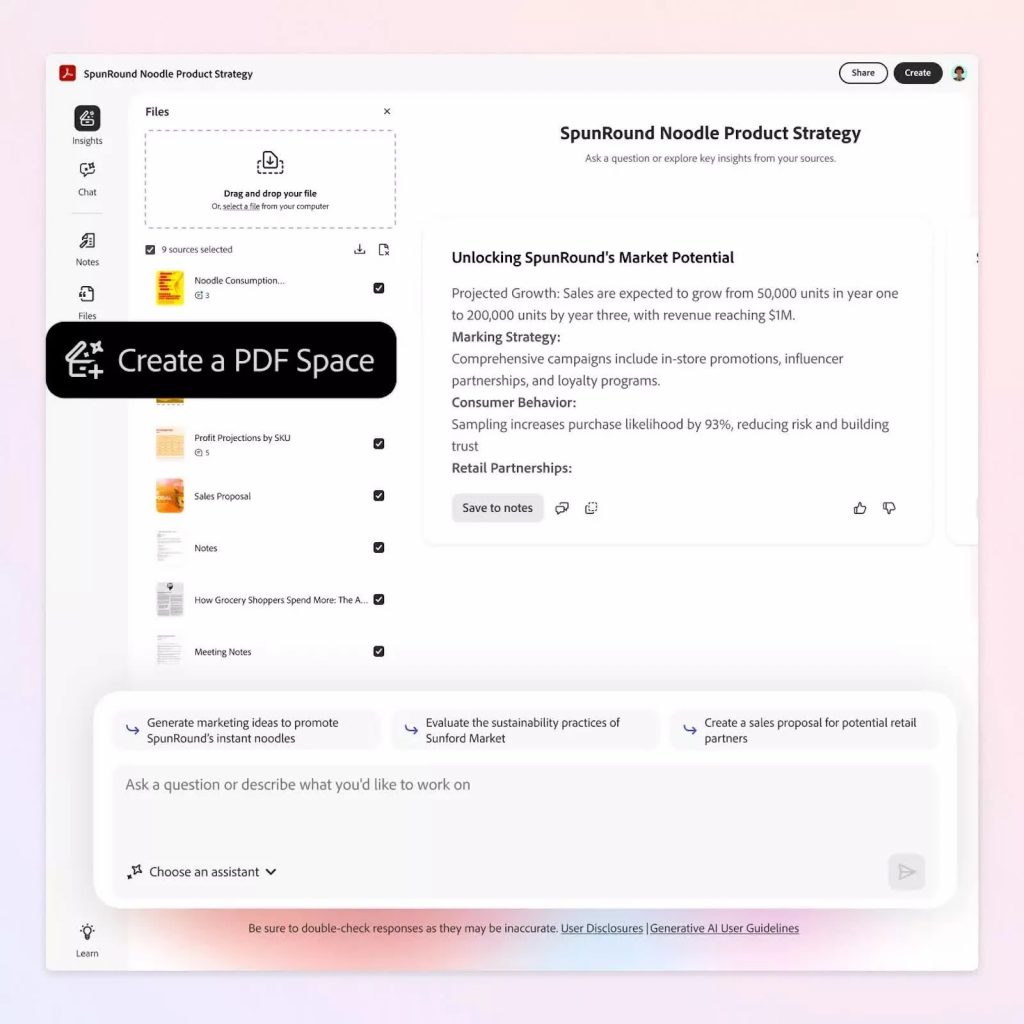

Of the 150 interviews with managers, a survey of 350 employees and analysis of 300 examples of the use of AI, only 5% of pilot programs brought millions of income, the rest did not bring either profit or losses. The leading author of the study by Adyatia Challapaly noted that the problem is not in AI models, but in their ineffective use.

Most companies are ineffectively spend resources, directing more than half of the budgets for marketing and sales, while the automation of the backing office brings the greatest return. Buying specialized tools is successful in 67% of cases, and own developments – only in a third.

The report was published after the warning of the Director General of OpenAi Sam Altman about the possible “bubble” of AI. “Only 5% of pilot projects for the implementation of AI bring millions, while the vast majority does not bring tangible [прибыли или убытков]. This means that the “95%” organizations get zero profit, ”the report said.

Against the background of the hypothesis about the “bubble of AI”, the shares of many companies began to fall rapidly, for example, NVIDIA shares fell by 3.5%, ARM Holdings shares – by 3.8%, and Palantir, which was analyzing data, suffered most: its shares fell by almost 9%. Analysts with the notorious Wall Street say that if the study is confirmed with the involvement of more companies, the AI market may expect stagnation: they will simply stop investing in this sphere.